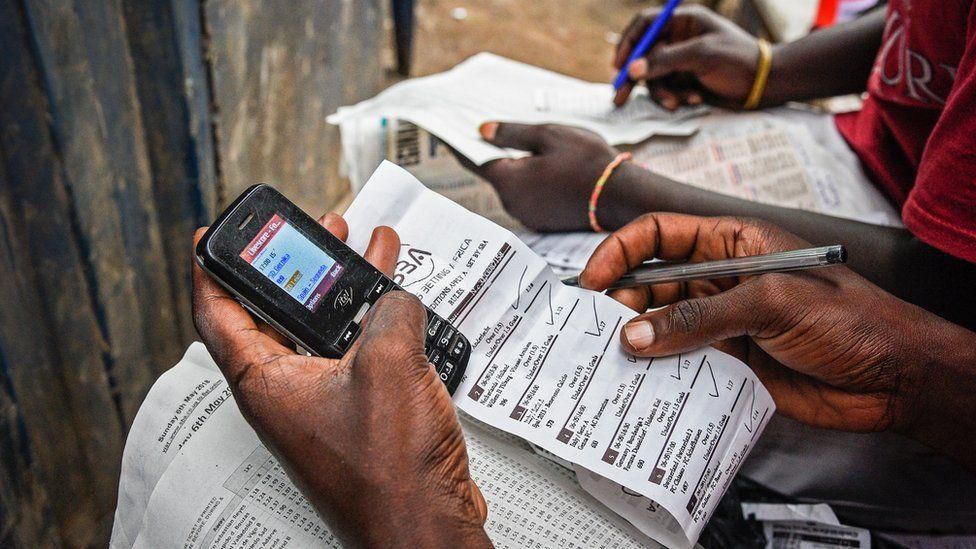

New 10 per cent tax increase on betting to patch revenue leakages

)

In April, the Ministry of Finance tabled the proposal to increase gaming and lotteries tax by 10 per cent under the Lotteries and Gaming (Amendment) Bill, 2023. This would push the tax from 20 per cent to 30 per cent.

When passing the new law, however, the Deputy Chairperson of the Finance Committee Jane Pacutho, there have been tax leakages which have necessitated the introduction of a uniform tax.

“To plug this revenue leakage, the measure proposes to remove the 15 per cent withholding tax on payments for winnings of gaming and instead increase the gaming tax to a rate of 30 per cent across the gaming sector,” Pacutho said.

The tax increment has been introduced under Schedule 4 of Clause 48(1) of the Lotteries and Gaming Act, 2016 which states that ‘an operator of a casino, gaming or betting activity issued with a licence under this Act shall, in addition to taxes prescribed by law, pay a gaming tax at the rate prescribed in Schedule 4’.

Schedule 4 of the existing law prescribes the rate of tax as 20 per cent of the total amount of money staked, less the payouts/winnings, for the period of filing returns.

Jane Pacutho was presenting a report on the Bill on Thursday 4, May, 2023. She mentioned that the 20 per cent tax rate will be maintained on sports betting.

Addressing tax leakages, she added that there are multiple start and stop points within some games which make it hard to enforce the tax point for winnings, including punter sessions for games like roulettes, poker and slots.

“Consequently, casinos are instead using the end-of-day reconciliations to account for withholding tax which would only be on the days when they have made losses. Such an occurrence is highly unlikely for a casino because betting/gaming companies are always winning,” reads the committee report in part.

The committee emphasized the need for adjusting the current policy to ensure the tax is only imposed on winnings and not the staked amounts.

)

)

)

)

)

)